AA - CPA - Audit & Insurance

Everything you need to prepare, learn & pass your certification exam easily. 90 days free updates. First attempt 100% success.

Last Update: September 16, 2025

Latest Question & Answers: 80

Exam Question Provider: CPA

Certification Exam Name: certified public accountant

First Try Then Buy!

- ✔ Complimentary Regular Updates

- ✔ Validated by Certified IT Professionals

- ✔ Immediate Access to Downloads

- ✔ Current and Comprehensive Study Guides

- ✔ 99.5% Proven Success Rate

- ✔ Completely Accurate Answer Key

(We will send your demo download links to your email address)

** We value your privacy. We will not share your email address.

Select Product

MOST POPULAR

Printable PDF & Test Engine Bundle

$140.98

Test Engine File for 3 devices

$74.99

Printable Premium PDF only

$65.99

CPA

Discount : 0%

Total Amount : $0

Real Exam Comes Weekly

90

Word to WordCustomers Passed Exam Monthly

89

Average ScoreExam Popularity Last 6 Months

1,086,359

Users Search for this ExamProduct Sales Yearly

8,670

Total Users Buy ExamsWhat is in Premium Bundle?

Single Choices 80

Hot Exams

Our pricing plans are simple and designed to cater to households and companies of various sizes.

Cisco 350-701

350-701 - Implementing and Operating Cisco Security Core Technologies (SCOR 350-701)

Buy Now

21 May 2025

Master the Audit & Insurance Exam: Enhance Your Skills with CPA Certification!

Exams Questions Provided By IT Professional.

Tech Professionals

21 May 2025

- Introduction

- Designed for Busy Professionals

- Understanding the Audit & Insurance Exam Format

- Trustworthy and Up-to-Date Content

- Pass Your Audit & Insurance Exam with Confidence

Earning the prestigious Audit & Insurance certification from CPA significantly boosts your marketability and opens doors to exciting opportunities. Achieving this recognized credential expands your career options and increases your earning potential. ExamPrince practice tests provide the most efficient way to prepare for and pass your Audit & Insurance exam on the first try.

To earn the Audit & Insurance certification, you'll need to pass the relevant exam offered by CPA.

Designed for Busy Professionals

Understanding the time constraints of professionals, we provide comprehensive

that fit your schedule and align with the Audit & Insurance exam objectives.

Understanding the Audit & Insurance Exam Format

Exam candidates are always interested in learning about the structure and nature of exam questions. ExamPrince resources address this by providing an overview of the format and types of questions you can expect on the Audit & Insurance exam.

Trustworthy and Up-to-Date Content

ExamPrince certified public accountant, include a concise set of questions that provide reliable, current, and relevant information on each syllabus topic that might be covered in your specific {examData.exam_title} exam. The questions are verified and confirmed by qualified professionals. You can be confident that you're receiving high-quality information and not wasting time on irrelevant or outdated material. Customer feedback consistently ranks ExamPrince certified public accountant, as the best available, empowering them to master Audit & Insurance exam content and achieve success.

Pass Your Audit & Insurance Exam with Confidence

With ExamPrince exceptional IT exam preparation materials, you can be sure of your success in your chosen Audit & Insurance exam. We offer a 100% money-back guarantee. Exam Prince serves a vast network of customers with state-of-the-art and exam-focused study materials that require as little as two weeks to prepare for the complete Audit & Insurance exam syllabus.

Audit & Insurance FAQ's

Introduction of CPA AA Exam!

The CPA AA Exam focuses on assessing the knowledge and skills of candidates in the areas of audit and insurance. It is a specialized exam within the CPA certification process, aimed at ensuring that professionals have a thorough understanding of auditing standards, procedures, and insurance principles.

What is the Duration of CPA AA Exam?

The CPA AA (Audit & Insurance) Exam is a professional certification exam designed for individuals seeking to demonstrate their expertise in auditing and insurance within the accounting profession. This exam is part of the CPA (Certified Public Accountant) credential, which is highly respected in the accounting industry.

What are the Number of Questions Asked in CPA AA Exam?

The number of questions asked in the CPA AA Exam can vary, but it typically includes multiple-choice questions, task-based simulations, and written communication tasks. The exact number of questions may change with each exam update.

What is the Passing Score for CPA AA Exam?

The passing score for the CPA AA Exam is generally 75 on a scale of 0-99. This score is determined by the American Institute of Certified Public Accountants (AICPA) and is consistent across all CPA exams.

What is the Competency Level required for CPA AA Exam?

The competency level required for the CPA AA Exam includes a deep understanding of auditing and insurance principles, the ability to apply auditing standards, and proficiency in analyzing and interpreting financial statements and insurance policies.

What is the Question Format of CPA AA Exam?

The question format of the CPA AA Exam includes multiple-choice questions, task-based simulations, and written communication tasks. This mix is designed to evaluate a candidate's knowledge, application, and communication skills in auditing and insurance.

How Can You Take CPA AA Exam?

You can take the CPA AA Exam at authorized Prometric testing centers. The exam is offered throughout the year, and candidates can schedule their exams at their convenience within the available testing windows.

What Language CPA AA Exam is Offered?

The CPA AA Exam is offered in English. It is important for candidates to have a strong command of the English language to comprehend and respond to the exam questions effectively.

What is the Cost of CPA AA Exam?

The cost of the CPA AA Exam varies by jurisdiction, but it generally ranges from $200 to $300 per section. Additional fees may apply for application and registration, depending on the state board of accountancy.

What is the Target Audience of CPA AA Exam?

The target audience of the CPA AA Exam includes accounting professionals, auditors, and individuals seeking to specialize in audit and insurance within the accounting field. It is ideal for those pursuing a CPA designation.

What is the Average Salary of CPA AA Certified in the Market?

The average salary of a CPA AA certified professional in the market can vary based on experience, location, and industry. However, CPAs with a specialization in audit and insurance can expect to earn between $70,000 and $120,000 annually.

Who are the Testing Providers of CPA AA Exam?

The testing providers of the CPA AA Exam are authorized Prometric testing centers. Prometric administers the exam on behalf of the AICPA and state boards of accountancy.

What is the Recommended Experience for CPA AA Exam?

The recommended experience for the CPA AA Exam includes a background in accounting, auditing, and insurance. Candidates typically have a bachelor's degree in accounting or a related field and relevant work experience in auditing or insurance.

What are the Prerequisites of CPA AA Exam?

The prerequisites of the CPA AA Exam include meeting the educational and experience requirements set by the state board of accountancy. This usually involves a bachelor's degree in accounting and a certain number of credit hours in accounting and business courses.

What is the Expected Retirement Date of CPA AA Exam?

The expected retirement date of the CPA AA Exam is not fixed, as the exam is periodically updated to reflect changes in auditing standards and practices. Candidates should check with the AICPA for the latest information on exam updates.

What is the Difficulty Level of CPA AA Exam?

The roadmap/track of the CPA AA Exam involves completing the required education, gaining relevant work experience, passing the CPA exams, and meeting any additional state-specific requirements for licensure.

What is the Roadmap / Track of CPA AA Exam?

The topics covered by the CPA AA Exam include auditing standards, audit planning and execution, internal controls, risk assessment, insurance principles, and the analysis and interpretation of financial statements.

What are the Topics CPA AA Exam Covers?

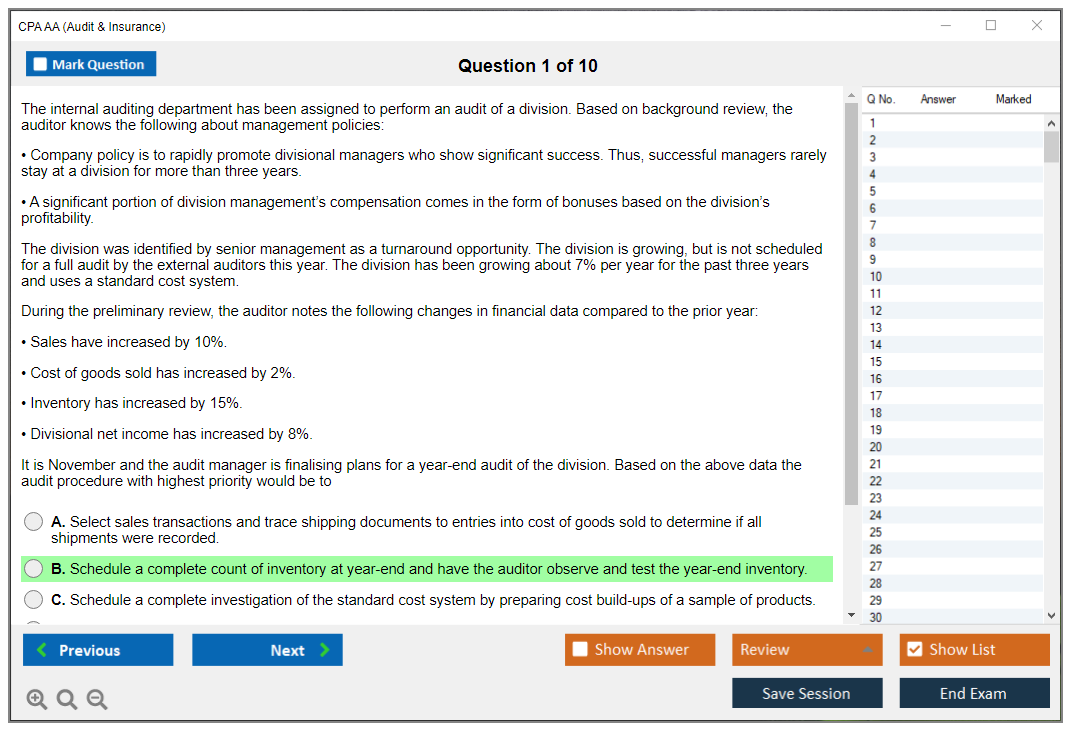

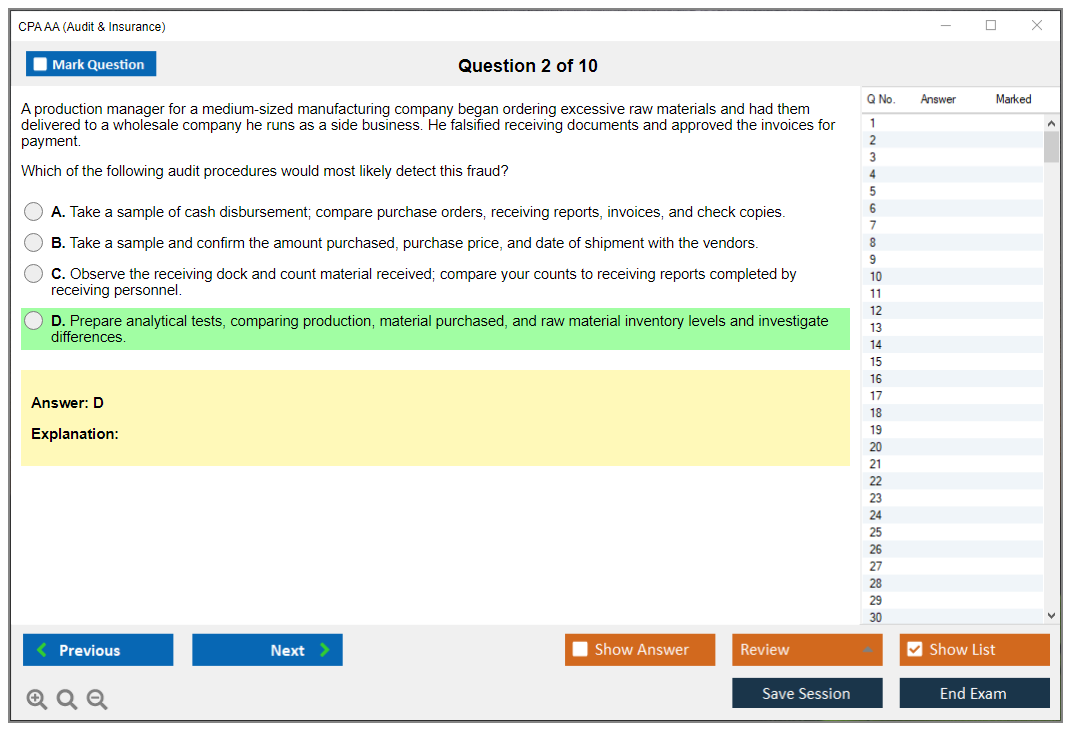

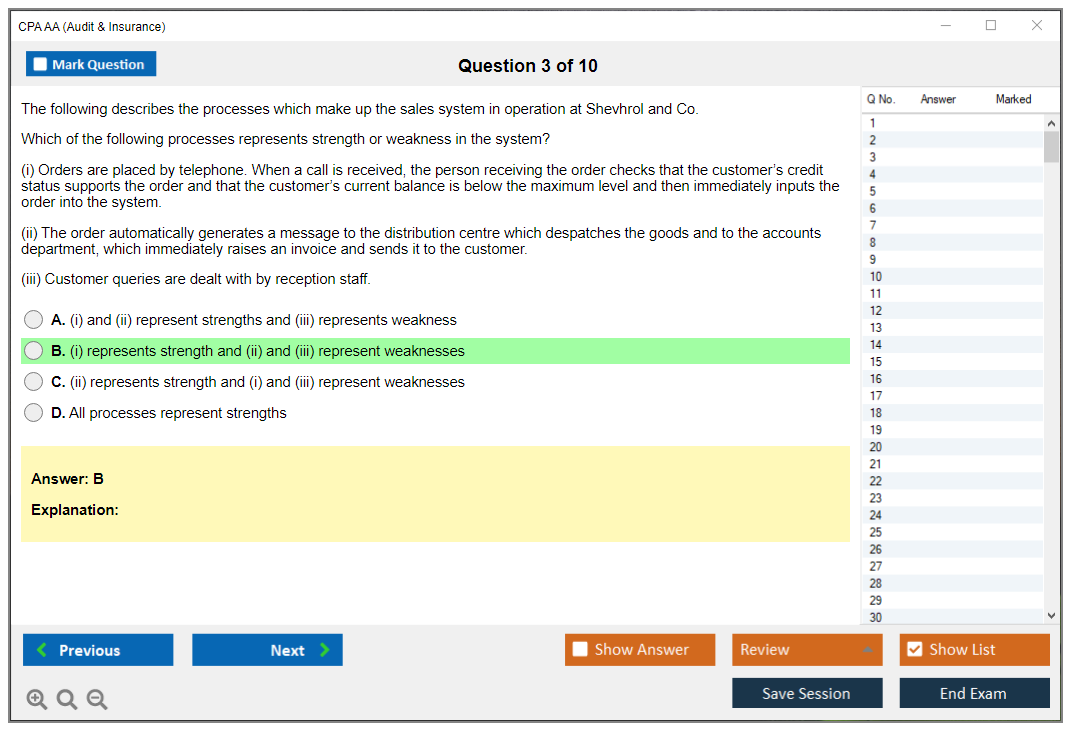

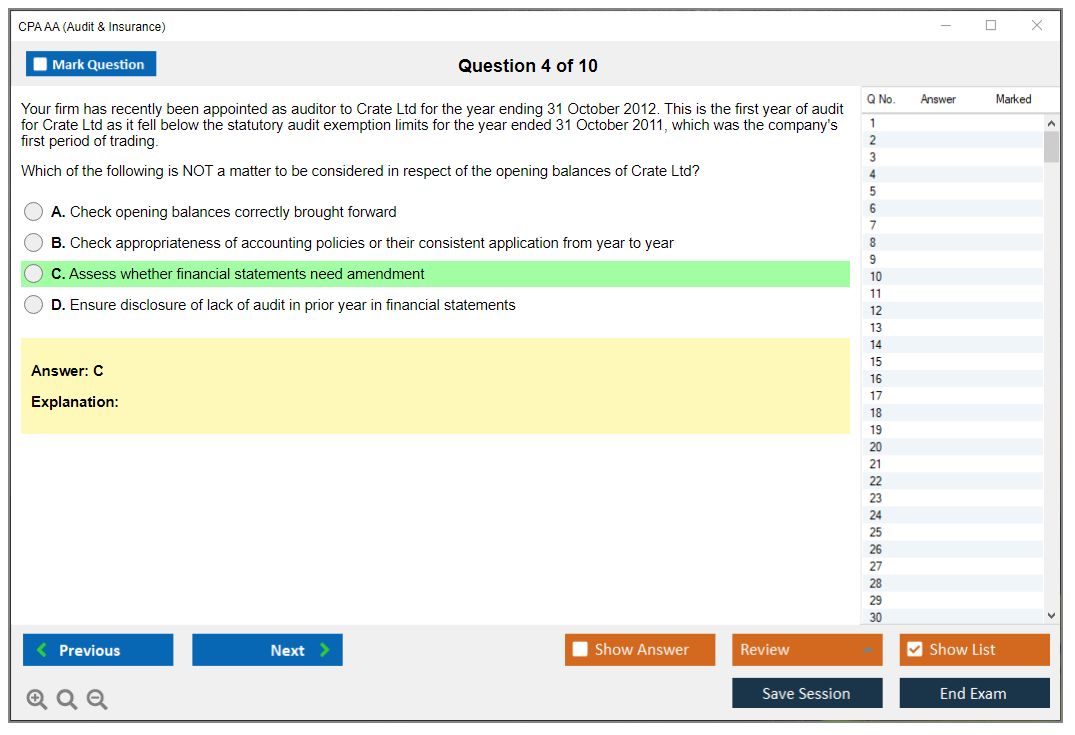

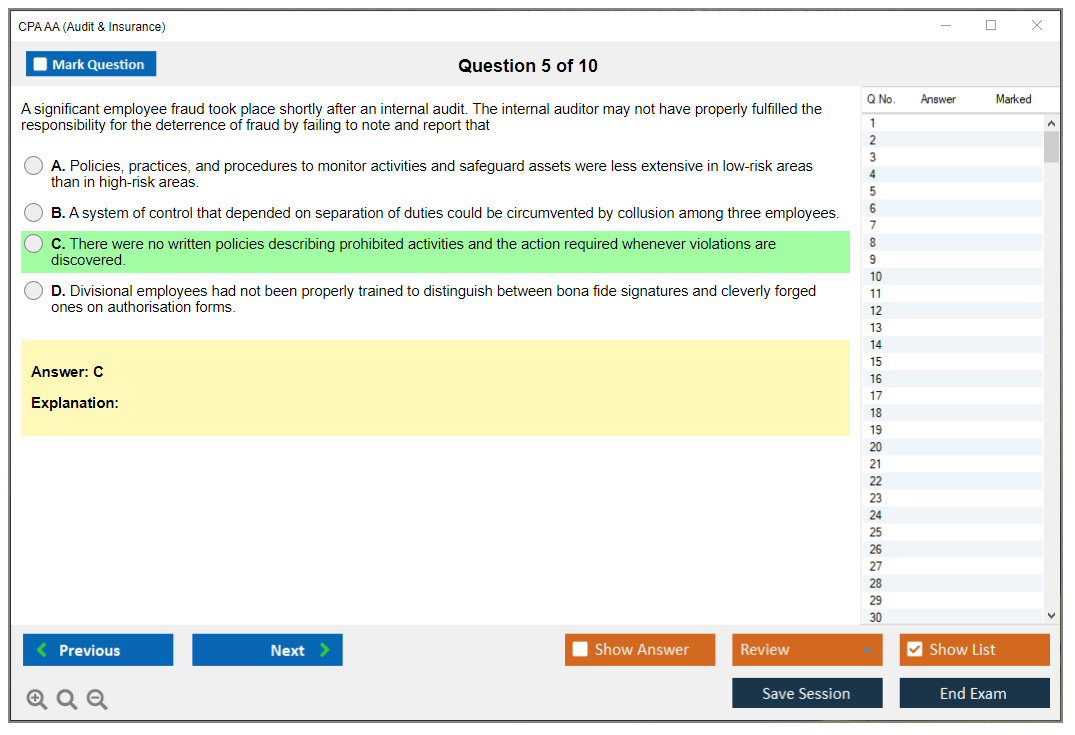

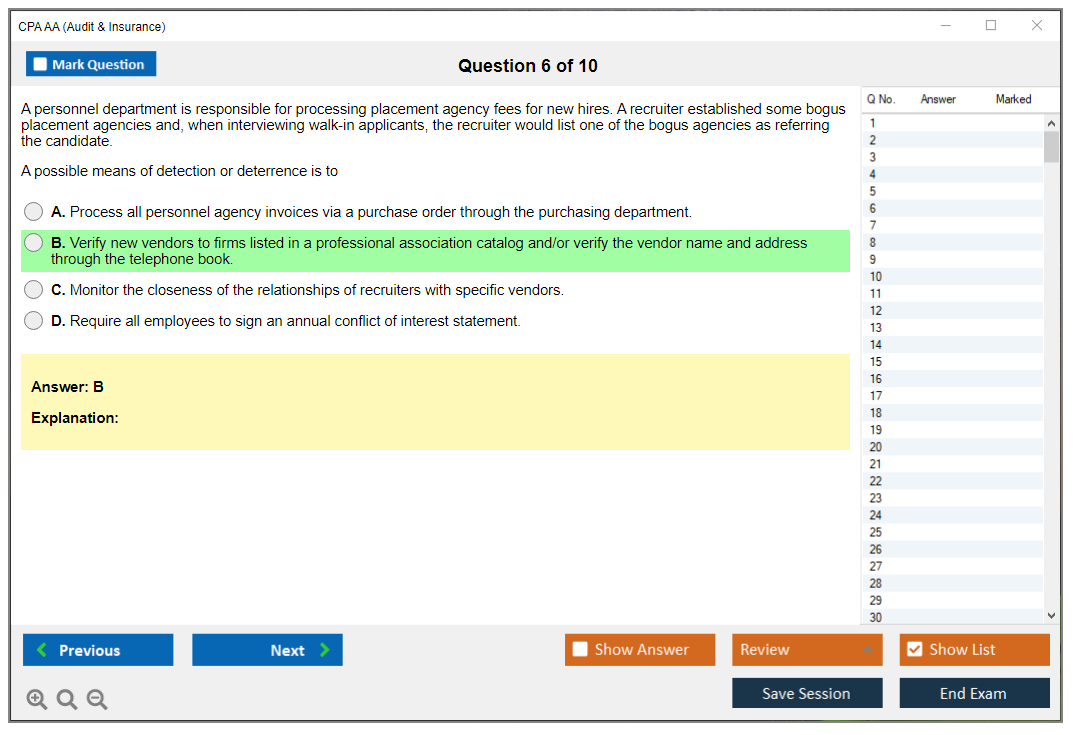

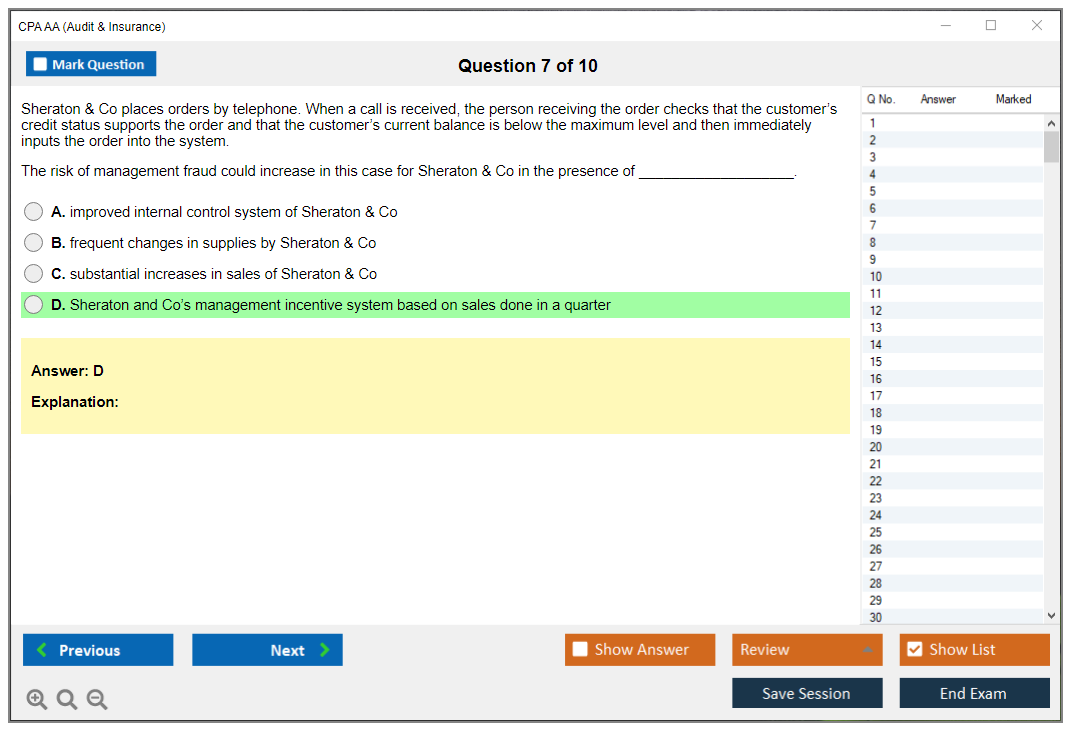

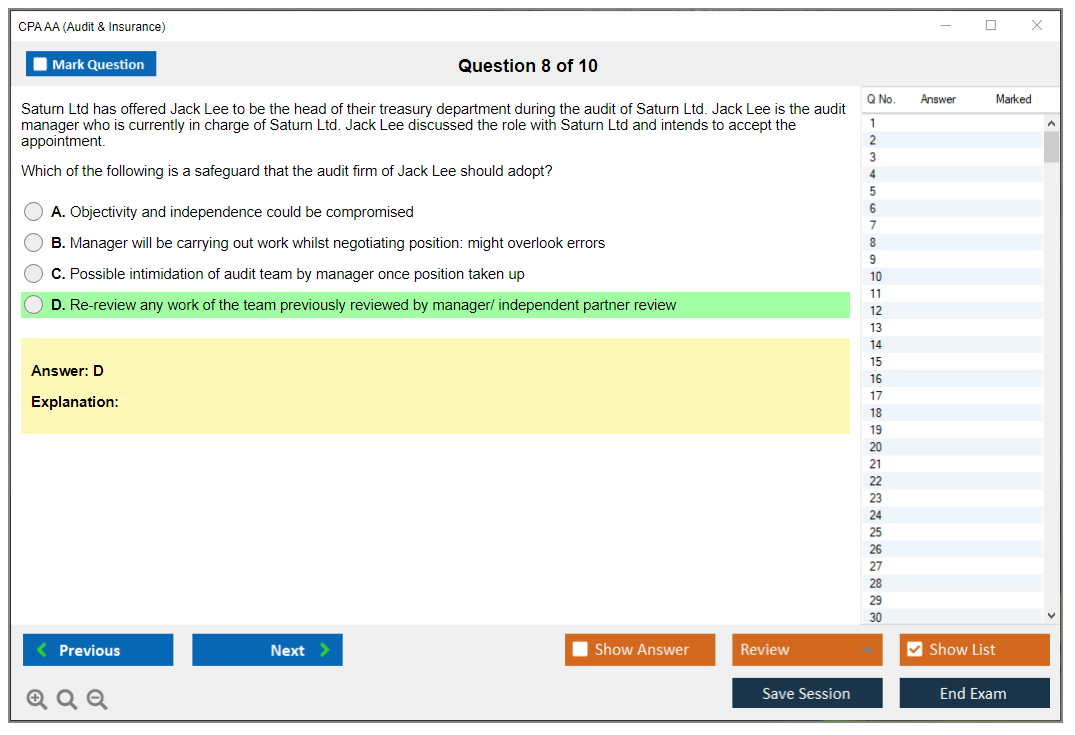

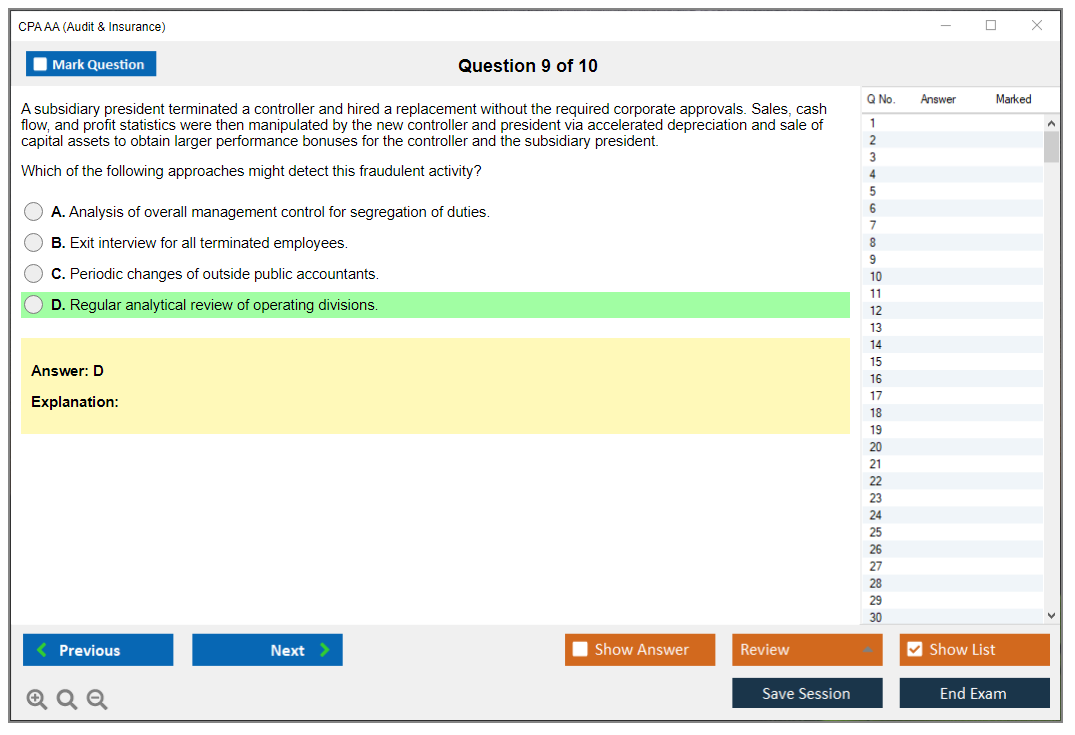

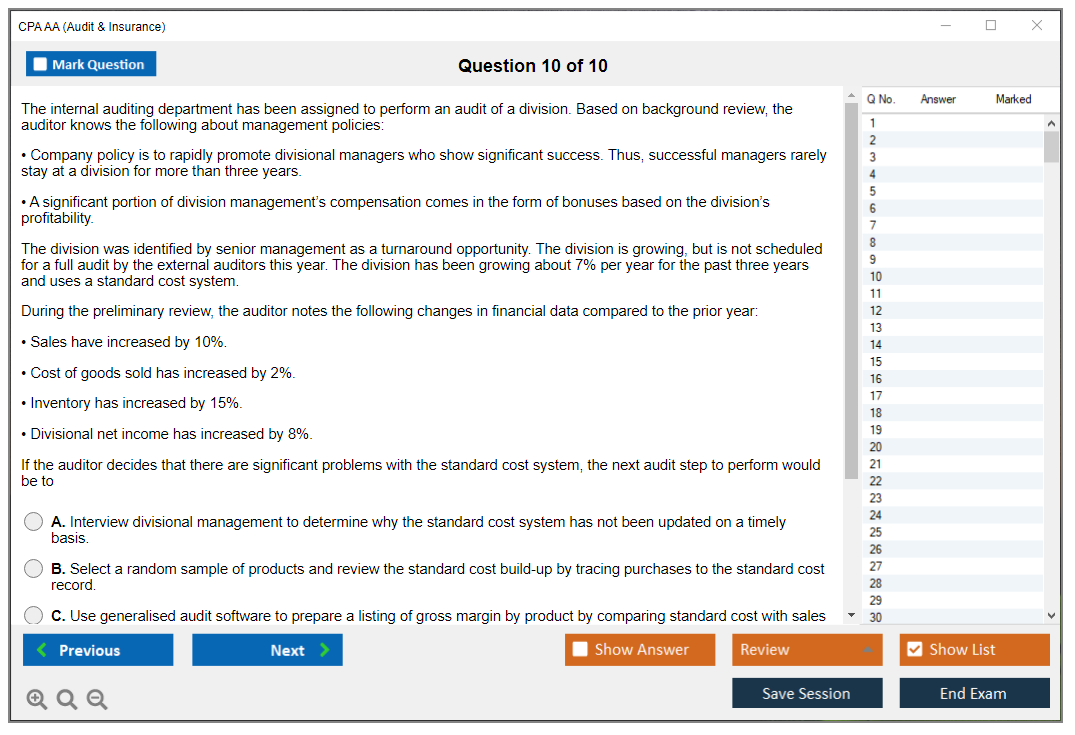

Sample questions for the CPA AA Exam can be found on the AICPA website and in various CPA review courses. These samples help candidates familiarize themselves with the format and types of questions they will encounter on the exam.

What are the Sample Questions of CPA AA Exam?

The difficulty level of the CPA AA Exam is considered to be high, as it requires a comprehensive understanding of auditing and insurance concepts, as well as the ability to apply this knowledge in practical scenarios.